|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Intricacies of Pet Insurance Costs: What Every Pet Owner Should KnowPet insurance, once a niche concern for the most cautious of pet owners, has burgeoned into a mainstream consideration that mirrors the complexities of human healthcare. The modern pet owner, in their quest to safeguard their beloved furry companions, often finds themselves navigating a labyrinth of costs and coverage options that can, at times, be as bewildering as they are essential. This article seeks to unravel the mystery of pet insurance costs by answering some of the most frequently asked questions surrounding this ever-evolving topic. At the heart of understanding pet insurance costs is the recognition that these expenses are influenced by a multitude of factors, each contributing to the overall premium in ways that may not always be immediately apparent. What determines the cost of pet insurance? is a question that naturally arises for many. The answer lies in the intersection of several elements:

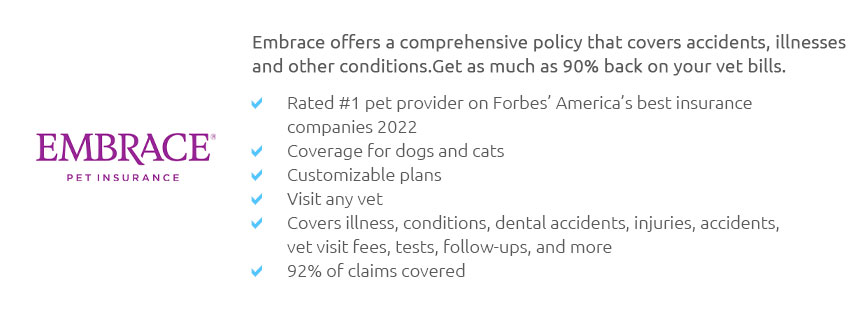

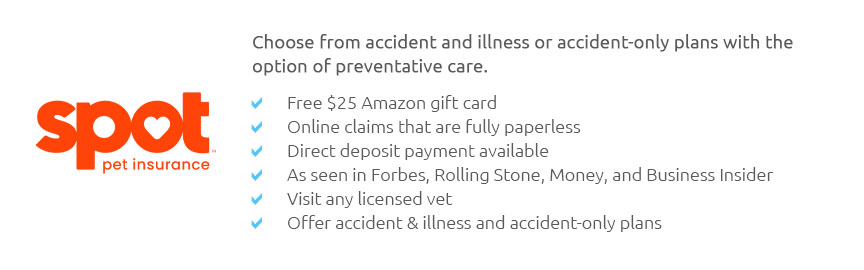

In addition to these, one might ponder how do deductibles and co-pays influence insurance costs? Much like human health insurance, pet insurance often involves deductibles-the amount you pay out-of-pocket before coverage kicks in. Opting for a higher deductible can reduce your monthly premium, though it shifts more immediate financial responsibility onto you. Co-pays, or the percentage of costs you're responsible for after meeting the deductible, also shape the final expense. A plan with a lower co-pay will usually cost more in premiums but could save you money on substantial vet bills. Beyond the technicalities of what influences cost, a poignant question for many is is pet insurance worth it? This question invites a more subjective consideration, weighing the peace of mind insurance provides against the potential financial burden it represents. For many, the decision hinges on the emotional value of their pet and their personal financial philosophy. Is it better to be prepared for the worst, or to save those funds for other needs? The answer varies widely, reflecting individual priorities and experiences. As we delve deeper into the topic, it's crucial to consider the role of competition in the pet insurance market. How does competition affect insurance costs? As more companies enter the fray, offering diverse plans and perks, the consumer benefits from increased choice and competitive pricing. Yet, this plethora of options can also overwhelm, making it imperative for pet owners to carefully compare not just costs, but the quality and scope of coverage. Lastly, many wonder how can I reduce my pet insurance costs? Savvy consumers might explore options such as bundling insurance policies, enrolling in wellness plans, or even taking proactive measures like maintaining a healthy lifestyle for their pets, which can sometimes lead to discounts. Furthermore, regularly reviewing and adjusting coverage as your pet ages or as financial situations change can help ensure that you're not overpaying for unnecessary coverage. In conclusion, while the landscape of pet insurance costs may initially seem daunting, a thoughtful and informed approach can demystify the process. By understanding the factors at play and aligning them with personal values and financial capabilities, pet owners can make decisions that not only protect their pets but also provide peace of mind. After all, in a world where our pets are often cherished family members, ensuring their health and happiness is more than just a financial consideration; it's a commitment to the love and companionship they unconditionally offer us every day. https://www.usaa.com/insurance/additional/pet

Pet health insurance is administered by Embrace Pet Insurance Agency ... https://www.petco.com/shop/en/petcostore/insurance

Our most popular coverage starts at around $90/month for two dogs, which includes a 5% multi-pet discount. Two cats on our most popular plan would cost about ... https://www.cbsnews.com/boston/news/is-pet-insurance-too-expensive/

The price hikes are based on the pet's geographic region ... the rising cost of veterinary care in the United States and inflation due to equipment improvements.

|